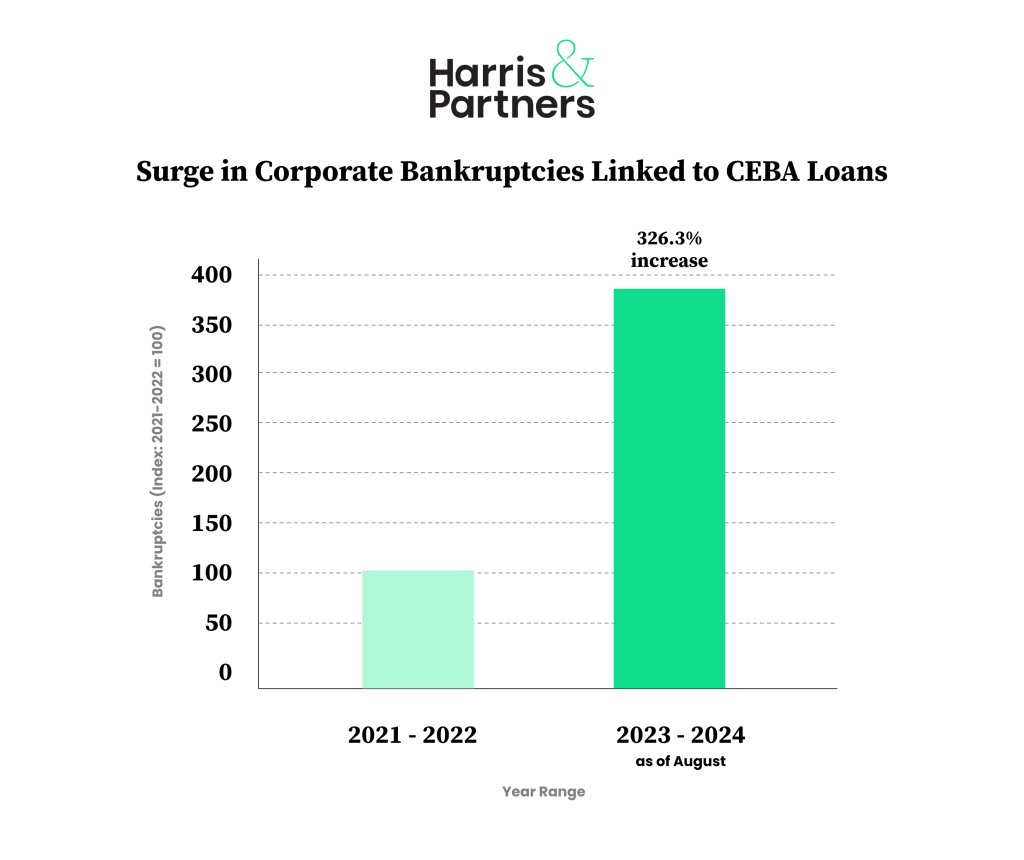

In recent years, Canada has seen a dramatic increase in corporate bankruptcies linked to the Canada Emergency Business Account (CEBA). Data from Harris & Partners Inc., Licensed Insolvency Trustee, shows a 326.3% surge in bankruptcies from 2021-2022 compared to 2023-2024 (as of August), highlighting a growing crisis as businesses grapple with CEBA debt.

Key Points:-

- What is CEBA?

- CEBA Loans: Not a Director Liability but a Growing Threat

- Expert Insights

- Economic Implications and the Road Ahead

What is CEBA?

The Canada Emergency Business Account (CEBA) was introduced in 2020 to support small businesses and not-for-profits facing financial hardship during the pandemic. CEBA offered interest-free loans of up to $60,000, with a portion forgivable if repaid by the deadline. While these loans provided essential relief during economic disruptions, many companies now struggle with repayments as deadlines approach.

Harris & Partners Inc.’s data reveals a sharp increase in bankruptcies, showing that CEBA has become a significant financial burden for businesses still trying to recover from the pandemic.

CEBA Loans: Not a Director Liability but a Growing Threat

CEBA loans are not a personal liability for directors, so business owners aren’t personally responsible. However, the impact on companies is severe, as mounting debts lead to cash flow issues, closures, and increased bankruptcies. This surge reflects broader economic challenges like rising costs, supply chain disruptions, and shifting consumer behaviors squeezing Canadian businesses.

Expert Insights

Joshua Harris, CIRP, LIT, of Harris & Partners Inc., shared his concerns:

“We are expecting to see even more corporate bankruptcies related to CEBA debts as repayment deadlines approach. It’s troubling that the government didn’t implement enough controls to ensure that the funds were used effectively, and now, many businesses are facing financial collapse. The lack of adequate oversight has turned what was intended as emergency support into a significant liability for many companies.”

Economic Implications and the Road Ahead

“The rapid growth in CEBA-related bankruptcies signals broader economic instability. As businesses struggle to repay these loans, the impact extends beyond individual companies, affecting employment, local economies, and Canada’s financial health. To prevent further distress, there is an urgent need for additional support measures and flexible repayment terms, ensuring businesses aren’t pushed to the brink of insolvency as they strive to recover from the pandemic’s aftermath.”